St. Augustine Public Adjuster

Example of what we do for our Clients

Insurance

Assurance Inc.

It is horrible to be a victim of an Insured Peril. Don’t let Yourself be victimized by the Insurance Company, their Contractors and/or Vendors.

We are here to Help!

(904) 454-3744

Insurance Assurance Inc. your premier Public Adjuster in St. Augustine, Florida. We are the Public Adjuster near you, St. Augustine Public Adjuster successfully represents policyholders throughout St. Augustine and all of Central Florida. We are Central Florida residents with our office located in Central Florida since 1999.

Free Consultation, No upfront fees. If we don’t document and collect more than you have been paid or offered, our services are FREE!! We get paid only after you do! We exclusively serve you, not the Insurance Company. Call us today 904-454-3744

Here are a Few Examples

of What We Do for Our Clients!

| INSURER’S ESTIMATE | OUR COLLECTIONS | DIFFERENCE | % INCREASE | STATUS |

|---|---|---|---|---|

| $3,559.62 | $31,784.41 | $28,224.79 | Over 793% | PAID |

| $11,215.49 | $486,602.87 | $475,387.38 | Over 4,239% | PAID |

| $23,850.00 | $285,262.35 | $261,412.35 | Over 1,095% | PAID |

| $40,753.74 | $178,802.57 | $138,048.83 | Over 339% | PAID |

| $25,434.27 | $130,670.29 | $105,236.02 | Over 414% | PAID |

| $36,244.43 | $181,964.90 | $145,720.47 | Over 402% | PAID |

| $22,199.27 | $99,199.70 | $77,000.43 | Over 347% | PAID |

Your Public Adjuster St. Augustine

This is what we did for a Client of ours In Celebration!

1. We Investigate and advised Insured what we could do.

2. Only then did we Contract with the Client

3. We Straightened out the mess the Insurance Company Created.

4. We documented, presented and Collected over 1000% More

Is this what our Competitors Provide?

Example: Celebration Fire Loss

We were contacted after a Celebration insured had a house fire as a result of the insureds unease with the happenings and concerns if they are being treated fairly.

After the Loss while still attempting to get their wits about them the adjuster arrived with the Insurance companies Premiere Contractor in tow.

As result of the Adjuster and Contractor making Assertions of Exceptional Repairs and Deductible savings. The Carrier induced the property owners into using the Premiere Contractor .

Was This true? NO!

We Collected over 1000% MORE than the estimation and made Significant Difference in The Quality of Repair.

Insurance Companies Contractor’s $64,909.67 Estimation

Dwelling

1. Our Investigation

1. Our Investigation

Review the structure and make determination of repairs necessary to restore the Structure in accordance with the Governing Restoration Standards and Building codes.

Review any Estimations that are available and determine their accuracy and/or Sufficiency.

Review any documentation available Fire Reports, Communications to and from the insured. Any pictures both prior to and after the event.

Review the Policy for Coverage and Possible Limitations.

What We Found

Through our initial investigation determined the Stricture Repairs would be approximately $300,000.

The Insurance Companies Contractor’s Estimation of $64,909.67. That is roughly a 4 1/2 times difference or OVER 450% Greater

Our Investigation found that on the same day the Insured received the Insurance Companies Contractor’s Estimation of $64,909.67.

Our Investigation Found that on the same day the Insured received the Insurance Companies Contractor’s Estimation of $64,909.67.

If an Insured asks an Insurance Company for one penny that they are not owed;

That is Insurance Fraud!

But If the Insurance Carrier Low Balls YOUR Claim,

That is a Mistake?

Our Investigation found that on the same day the Insured received the Insurance Companies Contractor’s Estimation of $64,909.67, the Junction box was installed and the Contractor and insurance Adjuster had agreed to lower the Repairs to $26,000.

After a cursory review we knew our recovery for this Claim would be in excess of 1000% of the Insurance Companies Ridiculous Estimation of $26,000.

2. We contracted with the client and moved forward.

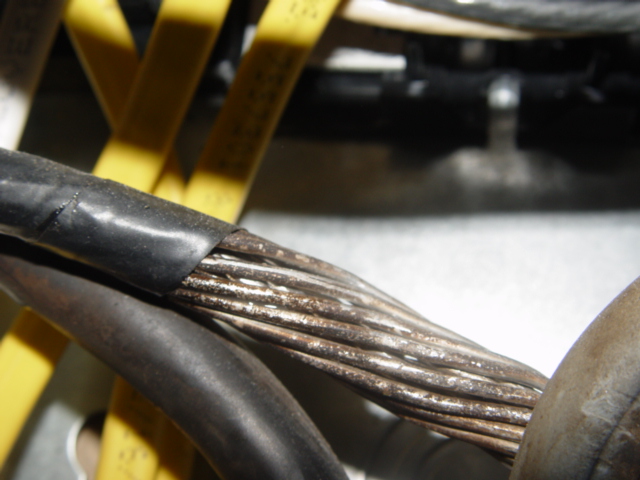

There has to be a Mistake? No one would write 10 times in their Estimate “The electric wires are melted in the laundry room; We are not allowed to splice on to the wires and must rewire the house. This involves removing ceiling to pull wires and cutting a path in wall for new wires and SPLICE the wires”.

We Authored a letter to the Contractor that there must be a Mistake or can the Contractor and Insurer be that unscrupulous?

Insurance Contractors Response to the Insured

On the electrical issue, I told you to ignore the electrical scope when I sent you the estimate. We did not splice the wires as you suggest. We installed a junction box below the electrical panel. This was discussed with the building department in advance, meets electrical code, and was inspected and passed by the county electrical inspector. It has not only saves everyone’s money, but it gives you a much better job. The alternative was to cut holes in the walls throughout your house and patch drywall in every room. This gives you a much cleaner drywall job. As far as getting your permission, we did get this. You signed a work authorization and a contract giving us the right to work on your house. We don’t ask permission for each detail of the work, we already have permission. Means and methods of the construction process are the function of the contractor.

Would the Insurance Company and/or their Contractor’s, Vendors put You and Your Families lives at RISK?

Contractor’s Assertions

True

or False

Ignore the electrical scope when I sent you the estimate

What good is an Estimate to you if it is to be Ignored?

The repairs are now less then 1/3 of what the consumer was advised.

Is that a Fraud?

We did not splice the wires as you suggest.

The Wires were Spliced using a Junction Box.

This was discussed with the building department in advance

That Would be Scary, if True!

Meets Electrical Code

See Below

Inspected and Passed by the County Electrical Inspector

That is Scary and True!

It not only saves everyone money

Who do you think is asking to SAVE MONEY?

It gives you a much better job

FAILS to MEET CODE. Created life and Safety Issue.

The alternative was to cut holes in the walls throughout your house and patch drywall in every room.

Competent Contractor’s complete Proper Restorations all the Time.

We don’t ask permission for each detail of the work-we already have permission

Any Qualified Contractor should not only complete the work contained in the Estimate given to the Consumer but to also explain there estimation and repair methods.

Means and methods of the construction process are the function of the contractor.

There are established Repair Standards and Competent Personnel should know and be properly trained in them.

What would another Public Adjuster Do for You?

This is What We Did!

Many of these Insurance Company Contractors receive the Majority of Their work from Insurance Companies.

These Companies had nearly 60 open permits on jobs and I am sure many from doing Insurance Companies work in Osceola County.

Are you TRUSTING the Insurance Companies contractor? Who has your interests at heart?

After contacting and meeting with the Head Building official a Reinspection was Scheduled.

Prior to the Re-inspection we had a neighboring Head Building official provide a letter of opinion and provided to the Osceola County Building Official at the time of the Inspection.

Pictures of some of the issues we identified

Electrical failures or malfunctions are a factor contributing to the ignition of nearly four of five house fires (79%)

As the Contractor stated above the job had been previously passed Inspection. Proper Re-inspection resulted in the repair being FAILED and TAGGED.

Building Official’s typically only make inspection of the work that is permitted in this case the junction box and would rarely make further inspection. An unscrupulous contractor can put you and your families lives in grave danger without you never knowing.

If this is Like a Good Neighbor, I would Change Neighborhoods

Unfortunately we have encountered this type of situation too often!

Investigating the loss, comparing to the Insurance Carriers Estimation

How Many Discrepancies Can there really be between the Insurance Companies Estimation and Public Adjusters?

In many of the cases we are retained the Insured was concerned over a few thousand dollars in difference and we end up showing them $10,000’s or even $100,000’s of thousands in difference!

3. We documented, presented and Proceeded to Collected over 1000% More!

The New Contractors Estimation

Insureds NEW Contractor’s $230,90.54 Estimation

Items we added as the New Contractor was Unaware

DWELLING CONTINUED

DESCRIPTION QTY. REPLACE TOTAL

Levolor Double Cell Shades 30 $187.00 $5,610.00

Spring Tension Pewter Curtain Rods 30 $ 19.99 $ 599.70

Curtain rods 4 $ 64.99 $ 259.96

Curtain Tapestry 8 $100.00 $ 800.00

Curtain Café Tier 10 $ 30.00 $ 300.00

Curtain Café Tier Valance 10 $30.00 $300.00

Tie Back Curtains 8 $100.00 $800.00

Tie Backs 16 $ 17.00 $272.00

Alterations 1 $ 100.00 $100.00

Installation 1 $ 125.00 $125.00

Refrigerator 1 $2,449.00 $ 2,449.00

Delivery & Installation 1 $ 79.99 $ 79.99

Washer 1 $752.04 $752.04

2nd story 1 $ 30.00 $30.00

Dryer 1 $807.42 $807.42

2nd story 1 $ 30.00 $30.00

Surge Protector Electric 1 $ 269.99 $269.99

Installation 1 $ 125.00 $125.00

Surge Protector Phone/Tv 1 $ 127.93 $127.93

Installation 1 $ 125.00 $125.00

Stanley CSS ( Alarm System) 1 $ 5,971.00 $5,971.00

Architectural Review 1 $1,800.00 $1,800.00

Content Manipulation & Debris removal $28,377.98

Sub Total $ 50,112.01

Sales Tax 7.000% $ 2,016.65

Overhead 10.00% $2,375.06

Profit 10.00% $2,375.06

Total $ 56,878.78

Mold Remediation/ Code & Ordinance are not included in the estimates to date and will be additional.

Can A Public Adjuster Really Make over 1000% Difference?

In Many Cases We Do!

Loss paid $414,254.66

Are all Public Adjusters created equal?

All Public Adjusters are not created equal. As a result of our principles own losses and dissatisfactions he encountered in retaining Public Adjusting services, he became a Public Adjuster and our company is founded to provide the best possible service for each individual client.

2.We ONLY Contract with a Client, when there is no doubt we will bring real value to the Insured.

We do not chase fires or canvas neighborhoods after devastating events and we ALWAYS bring value to our consumers.

Why Are We Different?

Years of experience and continued training in many restoration standards we know proper restoration standards for proper restoration.

We are familiar with many of the current Building Codes and will attempt to work with your Contractor to assure all funds necessary are tendered to assure your contractor is able to properly restore your loss.

In many of our Claims especially when of the nature as described above the Insurance company will incur most of our FEES as they maybe become recoverable.

True Care and Compassion for our Clients.

Hire both a Contractor and Public Adjuster that takes Pride in their work and won’t put your family at risk.

This is the Reason we Maximize Claims!

Will or Can another Public Adjusting Firm do the SAME?

Denials Don’t Scare Us!!!

Type of Claim : Business (Restaurant/Convenience Store) – Fire/Smoke

Location : Orlando, Florida

Insurance Company denied claim in its entirety. We documented damage and under appraisal clause of the policy recovered $125,000 for the insured

Type of Claim : Church – Wind/Water

Location : Pensacola, Florida

The church suffered water damages to the parsonage and Sunday school building. The Insurance Company denied the claim in its entirety. Recovery was $85,000 for the covered

| INSURER’S | ESTIMATE | COLLECTION |

|---|---|---|

| Denied | $2,300,000.00 | PAID |

| Denied | $329,186.76 | PAID |

| Denied | $184,670.00 | PAID |

| Denied | $81,682.27 | PAID |

| Denied | $27,629.92 | PAID |

Whether a Commercial or Residential Loss overcoming a Property Insurance Claim can be horrific and Insurance Assurance Inc. Can Help.

Were are here to Properly Document and Get the Maximum Recovery When You Need And Deserve It!

Water Damage Claims, Pipe Break Claims, Residential and Commercial Fire Claims, Hurricane and Windstorm Claims. We Properly Document any Property Claims and Get You the Maximum Recovery.

We Properly Document and get You paid to Restore Your Property not Just Minimalistic Repair.

Hiring the right public adjuster can alleviate much of the stress and hassle involved with getting your claim paid and GET YOU Significantly Greater Recovery!

Claims involving a public adjuster have historically resulted in significantly larger payments from insurance companies.